- Finance & Accounting

- Programming & Development

- Business

- IT & Software

- Marketing

- Office Productivity

- Design

- Sales

- Education Management

- Business Software

- HR & Recruiting

- Video Resume

- Small Business

- Women Owned Businesses

- Businesses Owned by People of Color

- Health and Wellness

- Sales and Marketing Example

- Video Blitz Submission

- Legal and Law

- Other

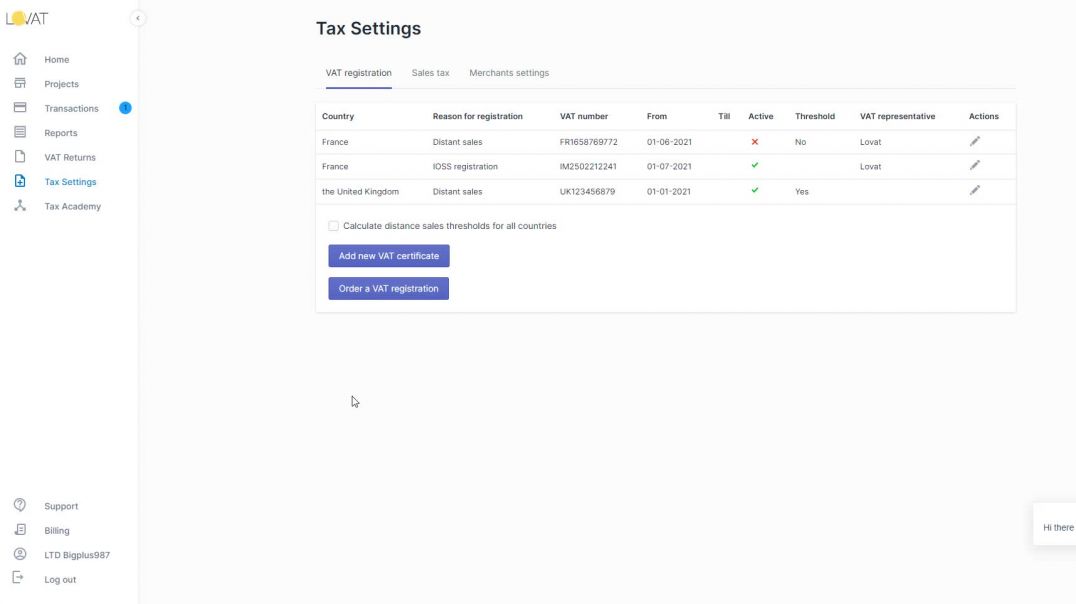

Stores and Tax Settings

Hello, in this video we'll show how to fill such sections as

"Stores" and "Tax Settings"

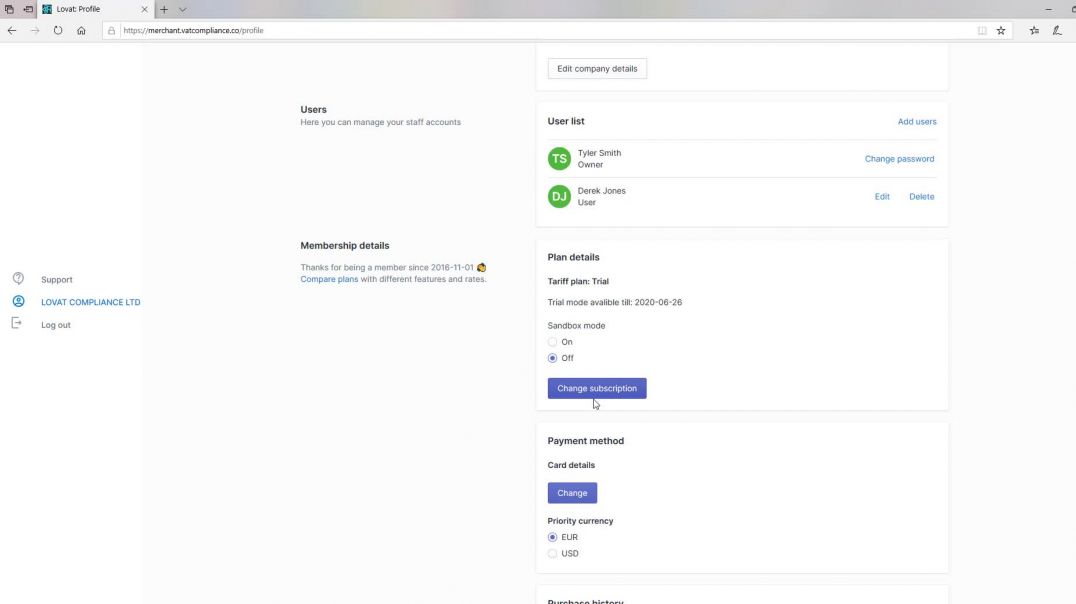

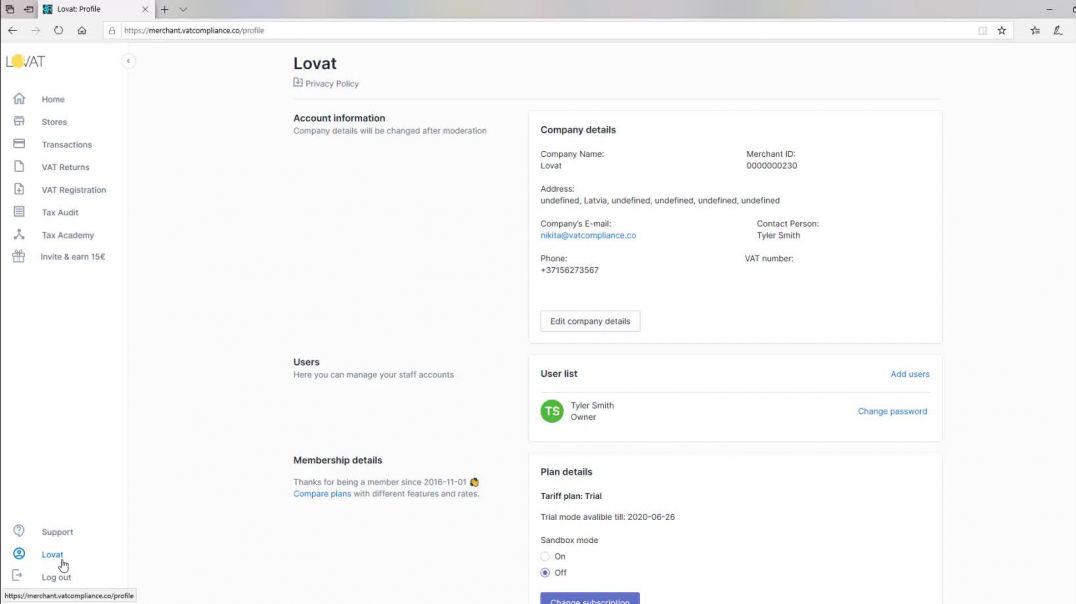

1) First of all, make sure that you have filled your company profile.

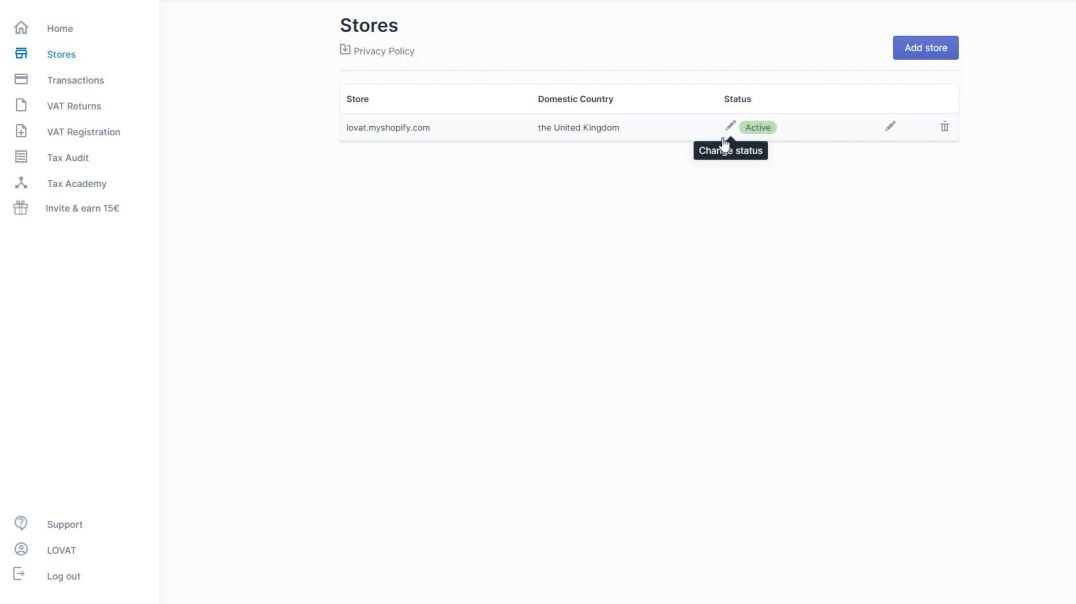

2) Afterwards, you need to complete integrations with your stores in the

"Stores" section.

If your store is managed by an Amazon fulfillment center or managed by a

merchant actual address will be uploaded automatically by default settings of

the platform.

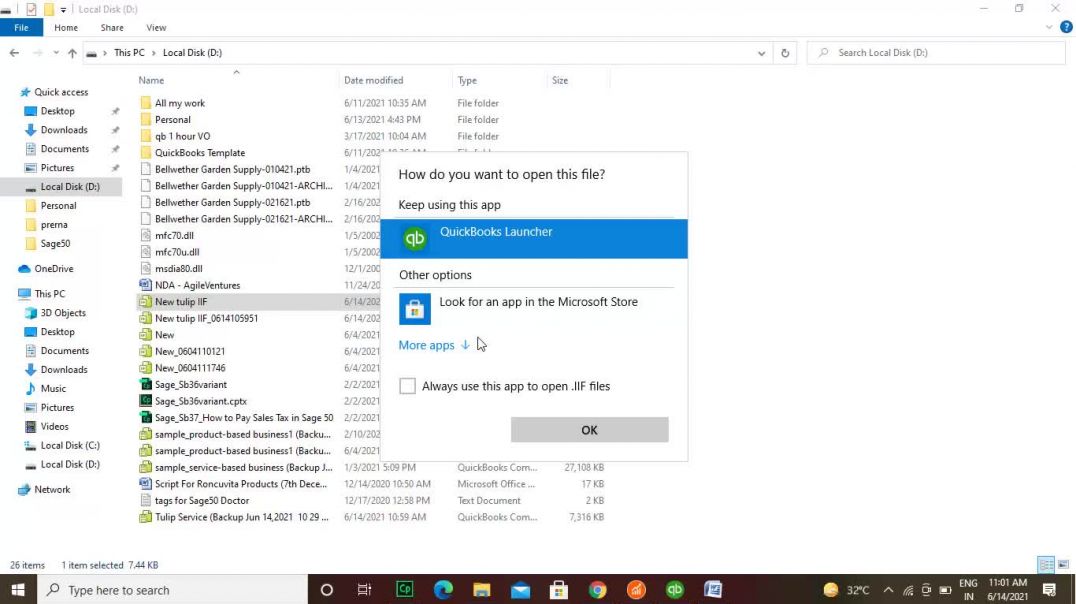

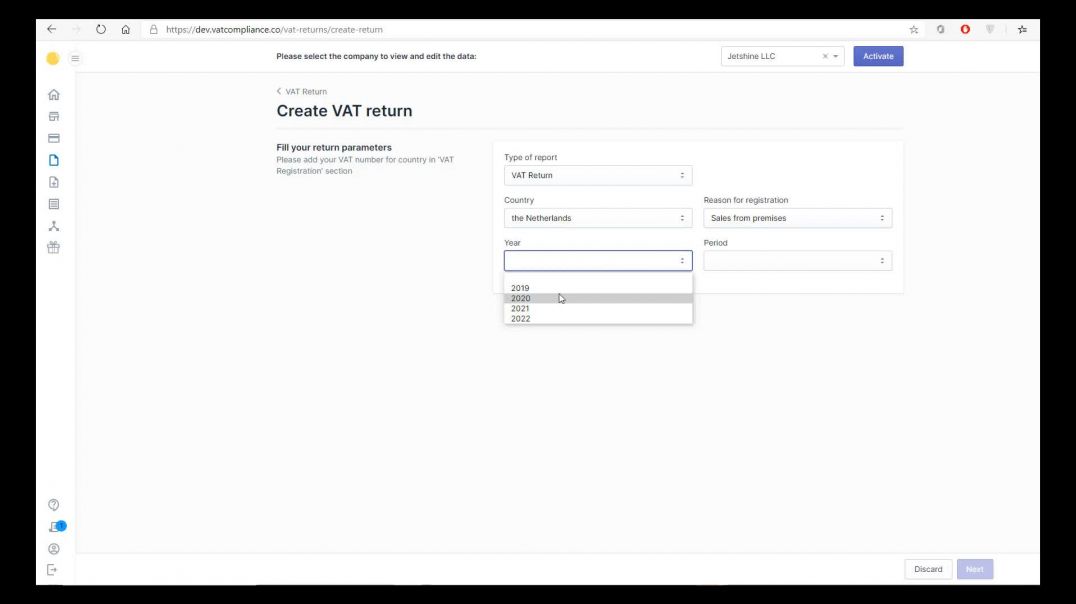

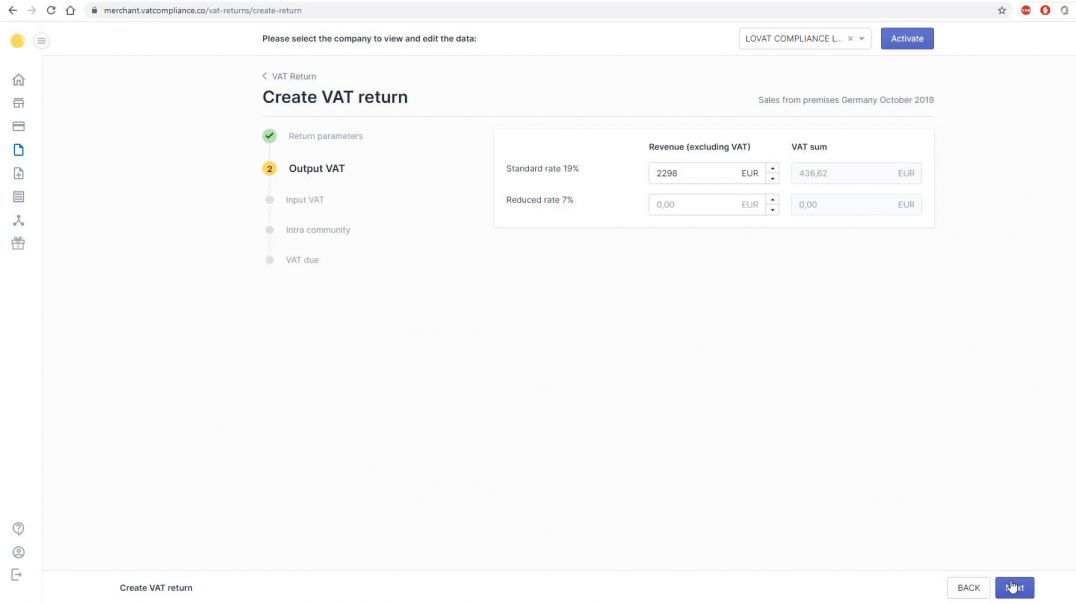

3) The next step is section "Tax Settings" where you need to

fill in information about your company in regards to VAT and Sales Tax.

Please note that you must add a VAT number by the VIES standard.

4) It's important to consider the reason for registration.

The next step is to add your actual date of registration.

Section "Valid till" will be applied only in case that you

need to deregister your VAT certificate.

Now, let's go to the Sales Tax section.

This section is intended only for the American market. If you have sales in the American market, then you need to add all sales tax permits.

Only after you add at least one sales tax permit you will see the sales tax return section.

For states where you have already added sales tax permits, you will have an understanding of the nexus.

If you want the Lovat platform to calculate the economic nexus for other states - please click "Calculate threshold for economic nexus for all

states" - and then you will see on the dashboard in which states you are approaching the nexus.

The next setting here is the section "Еxemptions"

This setting is very important if you are using the API provided by Lovat.