Latest videos

Custom Ecommerce Development Company Web Solutions

MartPro offers Custom Ecommerce Website Development Solutions for any type of business range just like, small, medium, and large. E-commerce web development has completely transformed the process of online shopping and has converted the way buyers purchase their equipment and services online.

We are one of the best professional ecommerce web development companies in India, and all our clients have experienced huge benefits through the implementation of our custom ecommerce development solutions. Our expert developers build customized e-commerce websites to build up your company completely while delivering success as well as an online business.

MartPro provides e-commerce web development support to clients with great software and development services for their exclusive requirements. Our highly and dedicated developers ensure that our client requirements fully fill their deadlines.

Full-Featured Solution For Diversified Ecommerce – How We Help?

Magento Development Services

Shopify Development Solution

Woocommerce Development Solution

Laravel E-Commerce Solutions

For further details, please visit our website https://www.martpro.net/custom....-ecommerce-developme

Looking to accept payments from users on your ecommerce store? Hoping to design a new website that is able to securely charge customers for their deals or paid downloads? Our payment integration services are what you need to get up and running rapidly, with minimal downtime, and to achieve PCI compliance on all your transactions.

Payment gateways integrate with other e-commerce tools, including subscription management software and payment processing software in the case of recurring payments, and allow merchants to accept credit card or other forms of electronic payments for transactions.

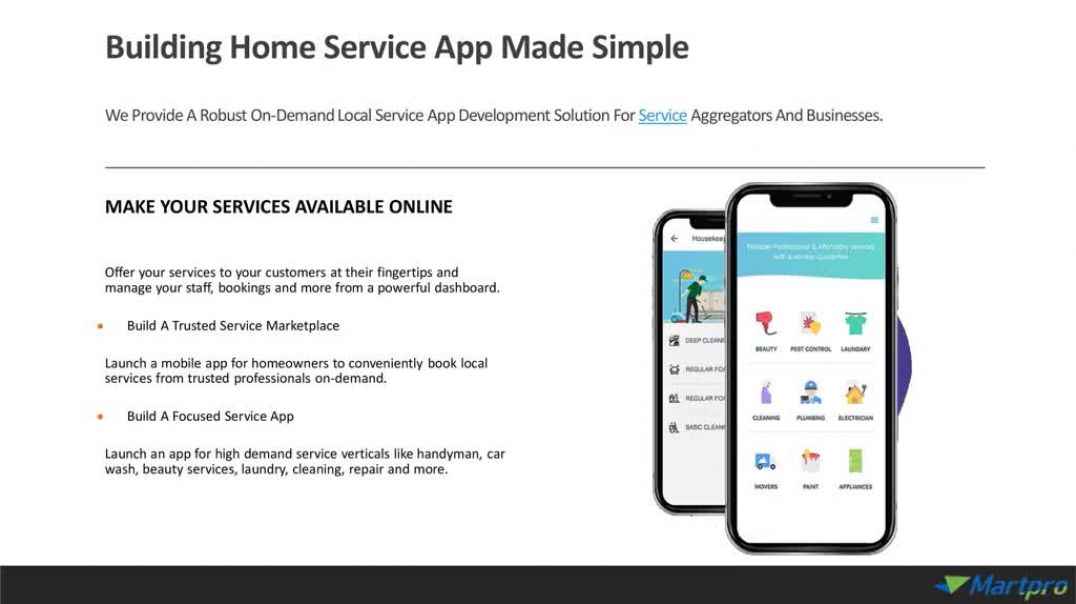

Looking to build home

services app? At MartPro, we feature a team of app developers having in-depth

industry knowledge and relevant expertise to deliver the best results.

For further details, please visit our website : https://www.martpro.net/home-services

5 things you need to create a successful coaching business using The H.E.A.R.T. Method.

Flexible and fast to launch

your own Online Travel Activity Marketplace Solution for your travel business

at MartPro.

For further details, please visit our website : https://www.martpro.net/online....-travel-activity-mar

Welcome to the video that talks about integrating QuickBooks and Salesforce. https://www.dancingnumbers.com/integrate-quickbooks-and-salesforce/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

Integrating the two have two benefits:

☑ Better opportunities for sale

☑ Better downloading of prospective opportunities

To integrate you need to download Salesforce Connector. You follow the instructions to install the SalesForce Connector.

Then, select the parameter and standards in the connector to integrate both the systems.

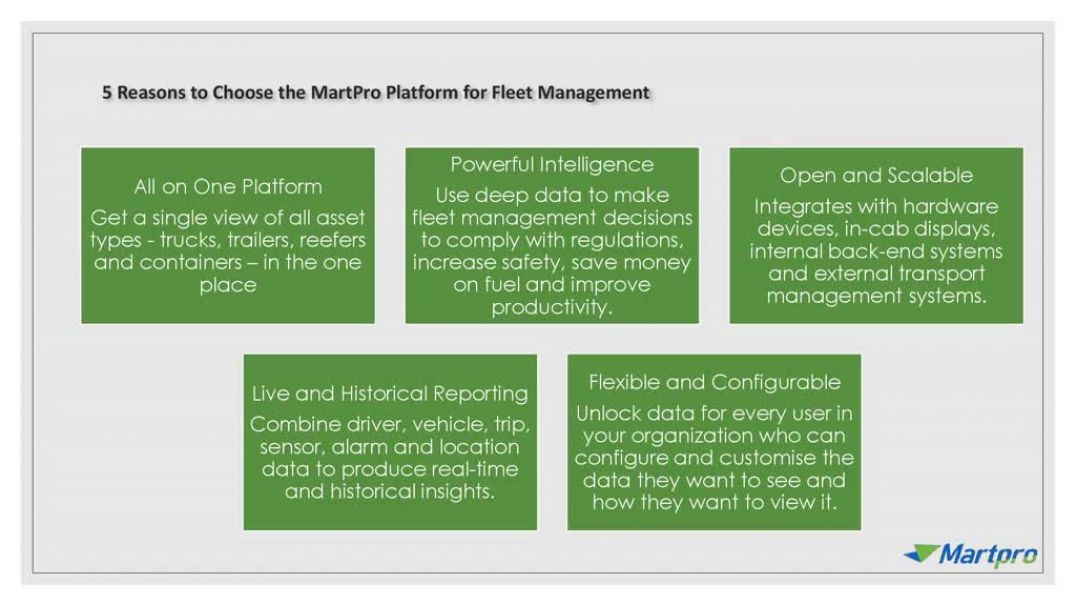

Ready to optimize your

fleet? Enhance Your fleet Operations with MartPro Robust Fleet Management

Software to track & monitor your fleet.

For further details ,

please visit our website : https://www.martpro.net/fleet-management

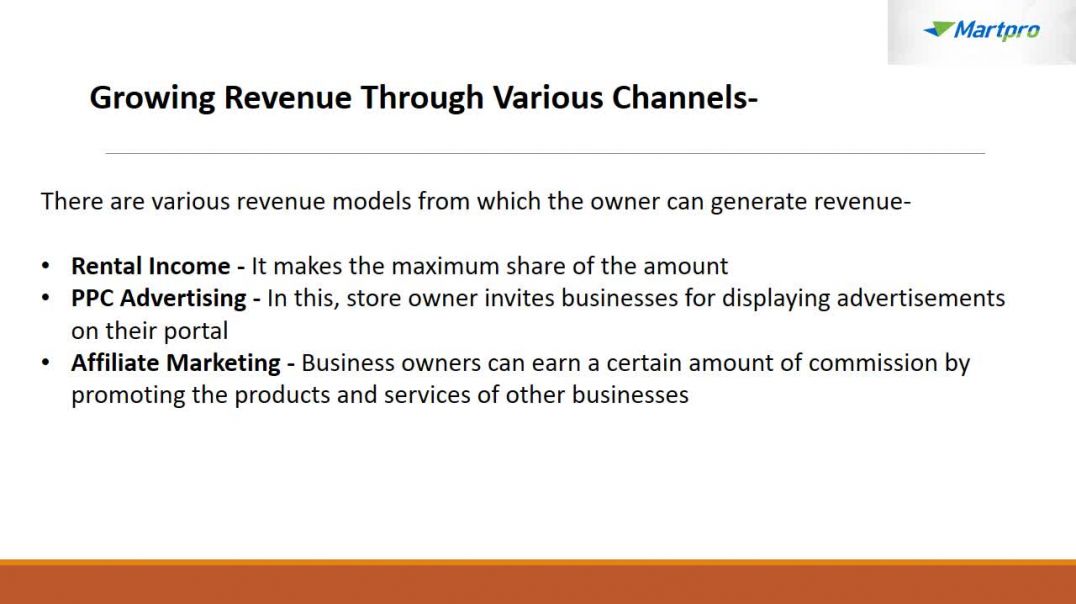

A daily deal system is a marketplace that connects app users with merchants for lucrative deals.

A seller or a merchant adds his products and services at a discounted price on the application, which is then accessed by the users and the two make a deal if it suits the needs of the buyer.

It is an eCommerce platform that offers deals on one or more products for a limited time, usually between 24-36 hours.

The business model has gained prominence over the years, and consumers have become savvy enough to use coupons available on these apps to purchase products. It is a commission-based business model as well.

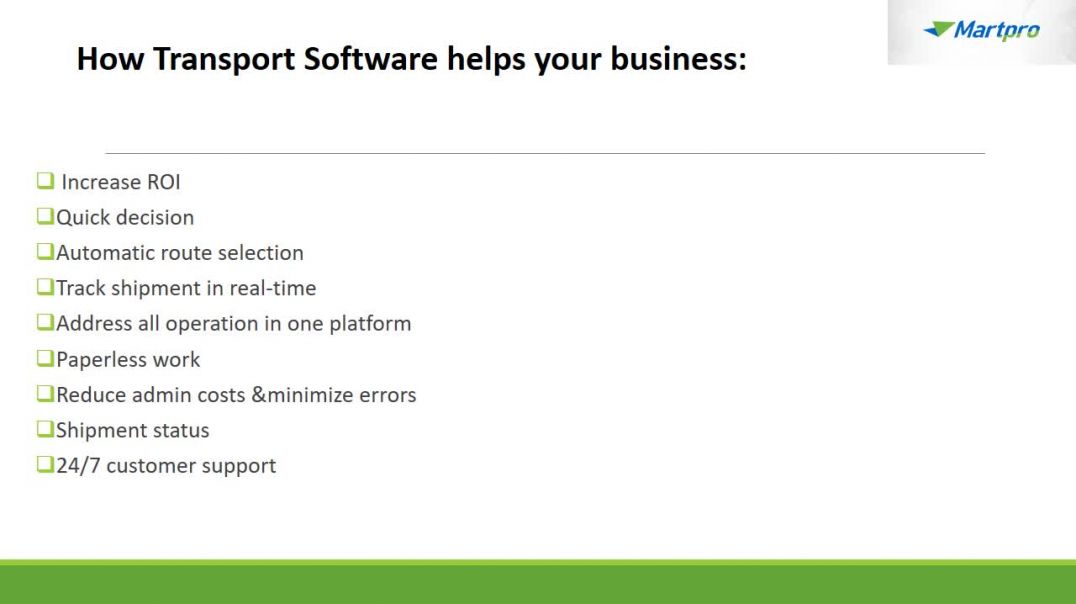

What is Transport Management Software?

A transport management software is a logistics platform that employs technology to assist businesses in planning, executing, and optimizing the physical movement of goods, both incoming and outgoing, as well as ensuring that the shipment is compliant and that all necessary documentation is available. This system is frequently integrated into a larger Supply Chain Management (SCM) system.

A transportation management system, also known as a TMS or transportation management software, provides visibility into daily transportation operations, trade compliance information, and documentation, and ensures the timely delivery of freight and goods. Transportation management systems also make it easier for businesses to manage and optimize their transportation operations, whether by land, air, or sea.

Create Your Own Ecommerce Website with Our Single Vendor Marketplace Platform

MartPro's single-vendor solution has an easy-to-use front design for launching a successful online rental website. The software has an attractive dashboard. A Single Vendor Marketplace is a website where a single seller sells its products to multiple customers.

There are only two parties involved in this easy buying and selling process i.e. the buyer and the seller. A single vendor marketplace does not provide its customers with a diverse range of products. Single vendor marketplace websites are also known as Stand-Alone Websites.

With a single-vendor rental eCommerce solution, everything is faster and many business processes require a more effortless approach, as there are lesser people involved in a selling-buying process and you have a single supplier.

Welcome to the video, which compares two of the leading accounting software available in the market. https://www.dancingnumbers.com/freshbooks-vs-quickbooks/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

We are comparing Freshbooks and QuickBooks.

Advantages of FreshBooks

The advantages of FreshBooks include:

☑ It offers multiple plans

☑ It offers live customer support

☑ It is highly intuitive platform

☑ It has an affordable pricing

☑ It is easy to set up and use

☑ It has an easy system navigation

☑ It suits the needs better for consultants and sole proprietors

☑ It allows choosing your preferred language and currency for any client

Disadvantages of FreshBooks

☑ It has limited report customization features

☑ It has no budget capability

☑ It is not the best for growing businesses

QuickBooks Online is the browser-based version of QuickBooks Accounting and is designed while keeping the small businesses in mind. It is a flexible application you can access from anywhere anytime.

Advantages of QuickBooks

☑ It boasts of an excellent reporting capability.

☑ Its plans are available for a maximum of 25 users.

☑ It offers in-product support and product training.

☑ It is easy to set up and use.

☑ It has an easy system navigation

☑ It has an easy tracking of payments for year-end processing.

☑ It suits the needs better for fast-growing and mid-sized businesses.

Disadvantages of QuickBooks

☑ There might be days when the program response time becomes slow during peak hours.

☑ Extra features are not visible on the main navigation screen.

☑ It is difficult accessing support from within the software application.

Thanks for watching the video which compared two of the leading accounting software in the market.

Create Your Own Ecommerce Website with Our Single Vendor Marketplace Platform

MartPro's single-vendor solution has an easy-to-use front design for launching a successful online rental website. The software has an attractive dashboard. A Single Vendor Marketplace is a website where a single seller sells its products to multiple customers.

There are only two parties involved in this easy buying and selling process i.e. the buyer and the seller. A single vendor marketplace does not provide its customers with a diverse range of products. Single vendor marketplace websites are also known as Stand-Alone Websites.

With a single-vendor rental eCommerce solution, everything is faster and many business processes require a more effortless approach, as there are lesser people involved in a selling-buying process and you have a single supplier.

Trawex is a one-stop-shop for custom web design services. As a highly experienced custom web design company, we have extensive knowledge of all aspects of web design, including graphics, programming, animation, flash, usability, and much more.

We have a team of talented and skilled designers who collaborate with us to create unique and useful websites for all of our projects. Our team has created thousands of extremely rewarding, creative websites for our clients. We provide high-quality custom web designs at affordable prices.

Trawex has a wide range of custom solutions for OTAs based on their target clients, such as a B2B booking system, a B2C booking system, a B2E booking system, a B2B2B booking system, and so on. By incorporating the best in class Supplier’s API you can make your portal incredibly fast, reliable and flexible.

Our custom app development services enable you to enter the new-age business world where customers are increasingly demanding. They want on-demand services, point-of-sale payments, are very budget-conscious, and expect services to be delivered quickly, efficiently, and without any quality compromises.

Our best web development services and custom software services range from a simple content management system to custom software development, custom ERP development, and smart analytical dashboards, and we have skillful expertise in deploying custom web solutions to clients of all shapes and sizes.

Throughout the journey, we develop a customized set of tools and technologies to deploy business-specific applications, which can greatly assist you in your business growth.

With today's changing travel industry demands, our travel portal software provides custom travel portal-related solutions. To meet your evolving needs, our experts have created the best-customized travel portal development.

We deliver customized solutions, which are long-lasting, such as B2B Booking System, B2C Booking System, Travel Agency Software, Tour Operator Software, White Label Travel Portal, Tour Booking Software, Package Booking Software, Car Rental Reservation System, Transfer Booking System, and Hotel Booking Software.

All this integrates easily with a global travel portals to allow travel agents to deliver exceptional deals for customers.

We've worked on website design projects for businesses of all sizes, from small local contractors to home service franchises, and we have a team of in-house website designers ready to tackle your next project.

If you are looking to implement custom software solutions into your business, connect with us at Trawex. Our expert developers build secure, scalable, and top-notch custom solutions for the tourism and hospitality sector.

Know more at: https://www.trawex.com/custom-travel-solutions.php

Contract, Trade Secret, Patent, Copyright, and Trademark: Choose your protection strategy wisely...

Trawex is the most demanding Flight Booking App Development Company, offering a mobile responsive flight booking engine that is highly effective and has met the client's goals all over the world.

We create custom, feature-rich, and user-friendly mobile applications to improve the user experience for our clients all over the world. Our flight booking app includes custom-made, features rich and user-friendly mobile apps to give a good user experience for clients.

We have strong expertise who will improve overall quality while meeting all customer demands and expectations. We assume that all of our clients should be satisfied with our services; thus, we are continuously seeking new ways to improve our services following market trends.

We have fully integrated flight booking software that manages the entire business process and ensures that the flight booking engine has all essential functions. We develop flight booking engines to help B2B and B2C travel agents get more booking.

Trawex provides a Flight Booking System with an advanced, user-friendly interface and solid backend architecture. With systems, you will be able to search and book airline seats easily and quickly by integrating with a major third-party airline supplier.

Our flight booking module allows you to increase profitability and manage more booking by selling airline tickets directly from the back-office system.

We can help you automate your airline ticket system to streamline your travelers' booking experience on the go. With our best-in-class mobile app solution, we make it simple for your customers to manage their itineraries and book flights.

Know more at: https://www.trawex.com/air-mobile-app.php

Trawex is a specialized company that offers a responsive bus booking system for travel management companies, destination management companies, travel agencies, and tour operators to cater to customers all over the world.

Our bus booking engine can help travel agencies in providing the bus inventory booked across the globe as per the choice of your customer currency. The bus booking engine provided by us can easily be integrated with your website as a white label booking engine.

We provide a real-time bus booking engine, bus booking system, online bus booking system integration services for travel companies. Bus Reservation System is designed to automate online ticketing through an easy-to-use online bus ticketing system.

Integrate our online bus reservation system into your website, and your customers will be able to book tickets for a variety of destinations. The bus ticket reservation system allows you to manage reservations, traveler details, and schedule routes, as well as set seat availability, etc. We create customized booking portals based on the needs of our clients.

Our Bus rental software is extremely user-friendly and includes all of the features required for your Bus rental business to run efficiently and smoothly.

Trawex, one of the best bus booking portal development companies, offers bus booking engines, bus reservation systems, and bus booking engine integration solutions for Bus Booking Portal Owners and Travel Agencies with cutting-edge travel technology!

Integrate our online bus ticketing system into your website, and your customers will be able to book tickets for several routes and destinations.

Trawex sets up a bus reservation system that involves a supplier dashboard, an extranet for bus operators, route scheduling, traveler seat selection, seat mapping, price and availability control, IBE, and more. We help bus companies of all sizes bring their operations online by utilizing cutting-edge bus technology.

Know more at: https://www.trawex.com/online-....bus-reservation-syst

Welcome to the video, which talks about credit card refund in QuickBooks. For more go through with video: https://www.dancingnumbers.com/quickbooks-credit-card-refund/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

You can refund the payment to the customer for a paid invoice or a sales receipt. So the partial payment can also be initiated to the customer according to the requirements.

There are some requirements that you must know about before processing the QuickBooks credit card refund process. These requirements are as follows:

The refund can be initiated up to the amount of the sale that is original but not more than that.

The credit card refund can be issued within 180 days of the sale that you have done to the customer.

Credit Card Refund for Sales Receipt

☑ Open QuickBooks Online

☑ Click on the New button

☑ Select the option Refund receipt

☑ Hit on the drop-down arrow of the customer field

☑ Choose the customer to whom you want to refund the credit card

☑ You have to Add the Details

☑ Now forms the section Refund from, you have to choose the payment method and also the Account

☑ When you are done with all the above steps, then click on the Save and Close button.

Credit Card Refund For Paid Value

☑ Open the QuickBooks Online in to the browser

☑ Click on the New button

☑ Choose the option Refund Receipt

☑ Click the Customer drop-down arrow

☑ Choose customers and add the details

☑ Select the payment method from which you are going to pay the refund of credit card

☑ Click Save and Close button

Send a partial Refund

☑ Click on the New sign

☑ Select the Refund Receipt option

☑ Click and drop-down arrow of the customer field

☑ Enter the details in the customer

☑ In the end, click on the Save and Close button

Thanks for watching the video.

Welcome to Dancing Numbers video about how to Import the CSV files into QuickBooks Online. For more visit: https://www.dancingnumbers.com/import-a-csv-file-into-quickbooks-online/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

#importcsv #quickbooksonline #csvfile

There are two major steps for the process.

Step 1: First of all, open the toolkit download file window and click on save.

Step 2: Choose the location for the CSV.

Step 3: In this step, double click on the .exe file so that toolkit winzip self-extractor window can get opened.

Step 4: Now click on browse and choose the location where you wish to install the toolkit and click on OK.

Step 5: After this step, click on unzip to extract the content and close the self-extractor window. And open the QuickBooks import excel and CSV folder from the location you saved it earlier.

Once you download the toolkit, there will be a PDF document in it for importing Excel and CSV files with all the instructions, best practices and notes.

Welcome to Dancing Numbers video about how to Import Journal Entries into QuickBooks Online. For more visit: https://www.dancingnumbers.com/import-journal-entries-into-quickbooks-online/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

There are two major steps for the process.

Step 1: Prepare the Spreadsheet

☑ First of all, you need to keep the spreadsheet ready for the import process.

☑ Use the right spreadsheet format

☑ Fill in all the mandatory data

☑ Choose the correct date format as prescribed by QuickBooks

In case you are moving from QuickBooks Desktop to Online, then try and format it to suit the QuickBooks Online.

☑ Create a New Accounts in Chart of Accounts

☑ Open the QuickBooks online

☑ Click the Setting icon and then, choose the Chart of Accounts

☑ Select an account type

☑ Provide a description

☑ Choose all the relevant information

Step 2: Proceed with journal Entries Import

☑ Go to Settings and then, select Import Data

☑ Then, select Journal Entries

☑ Find and select the Excel or CSV file and then, click Open

☑ And, then, hit the Next Option

☑ Start mapping of the data and then, give a click Done

This is the way in which you import journal entries into QuickBooks online.

Welcome to QuickBooks Tutorial for professionals. This is a complete guide for the people who use QuickBooks for their bookkeeping and accounting purposes. We have deliberately divided the training into two parts. https://www.dancingnumbers.com/quickbooks-tutorial/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

#QuickBooksTutorial #QuickBooksUS #Tutorial #Download #Setup #Accounts #Accounting #QuickBooksAccounting #ChartofAccounts

Table of Contents

00:00:08 Download QuickBooks Desktop Version 2021

00:04:05 Navigating QuickBooks Desktop

00:07:40 Creating Company File in QuickBooks Desktop

00:10:46 Creating a Local Back Up of QuickBooks Desktop

00:12:14 Restoring Local Company Back Up

00:13:30 Setting Up Users

00:16:55 Editing and Deleting Users

00:19:01 Using Chart of Accounts

00:22:45 Creating Customers and Jobs

00:39:00 Using Employee Lists

00:52:28 Using Inventory Lists

00:56:54 Estimates

01:01:33 Creating Invoice

01:04:17 Basic Sales

01:07:09 Creating Batch Invoices

01:08:38 Creating Sales Receipts

01:09:17 Setting Financial Preferences

01:14:27 Enter Statement Charges

01:17:26 Create Statements

01:26:43 Entering Partial Payments

01:40:55 Recording Full Payments

01:55:11 Apply One Payment to Multiple Invoices

02:07:23 Enter Over-payments

02:09:50 Enter Prepayments

02:11:48 Use Pricing Levels

02:14:17 Applying Credits to Invoices

02:15:53 Making Deposits

02:17:56 Automatically Transfer Credits Between Jobs

02:20:53 Create Memos and Refunding Customers

02:21:58 Using Bank Accounts

02:22:33 Entering and Paying Bills

02:23:53 Paying Sales Tax

02:27:57 Using Graphs

Other Data Import Videos:

Import Bill Payments: https://youtu.be/N4_F4J2aNw8

Import Bills: https://youtu.be/RByrG7j-byk

Import Charges: https://youtu.be/AMfDTSKATQM

Import Checks: https://youtu.be/PIwnMiScSlk

Import Credit Card Charges: https://youtu.be/-HRA2PY2YD4

Import Credit Card Credits: https://youtu.be/pDQYddMSfek

Import Credit Memos: https://youtu.be/swXbRpuvnW8

Import Estimate: https://youtu.be/qecvNsO_gBw

Import Inventory Adjustment: https://youtu.be/rTpIhVVVpJ0

Import Invoices: https://youtu.be/q77uSG7dEN8

Official Website: https://bit.ly/2Liao7H

Get Support: https://bit.ly/39QQ6w9

You can follow on Social Media:

Facebook: https://bit.ly/33SO5Mk

Twitter: https://bit.ly/3lVfnb8

Instagram: https://bit.ly/3oBuisq

To download and setup Dancing Numbers 7-day free trial for Import, Export & Delete Data in QuickBooks. https://www.dancingnumbers.com/free-trial/?utm_source=intuit-community&utm_medium=affiliate&utm_campaign=yogesh

In this video know the comparison (Price, Features & Integration) of Square & Paypal, user can also know which one is better for your business. https://www.dancingnumbers.com/square-vs-paypal/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

Paypal

PayPal has been one of the most prominent players in the payment processing space and one of the most recognizable platforms as well. Many customers have made a habit to use PayPal as a suitable alternative to credit card transactions. It offers an incredible value with its comprehensive payment system.

Advantages of PayPal

Certain Important advantages offered by PayPal are listed below:

☑ Have a large number of loyal customers

☑ Makes international selling possible

☑ Predictable pricing

☑ Can be easily integrated with other applications

☑ Efficient developer tools

☑ Accept in-person payments from PayPal and other platforms

Square

Because of its advanced features, Square has made quite a name for itself in the payment processing industry. It is easy to use, affordable and transparent platform. Even though, it is not ideal for global or high-risk businesses, it certainly fits the requirements perfectly for small business owners.

Advantages of Square

Certain important advantages offered by Square are listed below:

☑ Modern tools and an impressive set of features

☑ Free add-ons

☑ Comprehensive and multichannel payments system

☑ Specially Designed POS systems for retails, restaurants, and appointment businesses

☑ Free virtual terminal and other eCommerce tools

☑ Proprietary POS options such as Square Terminal, Square Stand and Square Register

☑ Zero chargeback fee

Common Features to Square and Paypal

You can expect the following from both:

☑ Accepts of all kinds of credit cards

☑ Free mobile POS services compatible with almost all devices

☑ Smooth recording of cash transactions

☑ Keyed transaction support

☑ Both partial and full refunds

☑ Item library with product descriptions, images, and variants

☑ Loyalty and discount programs

☑ SKUs and Barcodes

☑ Email/SMS receipts

☑ Recurring billing

☑ Receipt printing

☑ Invoicing

☑ Cash drawer support

Connect QuickBooks to PayPal?

When you connect QuickBooks to PayPal then you can easily categorize, edit, or match the transactions. You can do these transactions in the same way you did your bank transactions.

☑ Get gross and net sales

☑ See details at a glance

☑ Review Transactions

☑ Track fees separately

How it works after integrating PayPal with QuickBooks?

The data flow is automatic in between the software and you can check it out at one place. Here are the steps that let you know how it works:-

1. Firstly, connect your account

2. Auto-Sync the sales data

3. Review the PayPal transactions before adding them to your books

4. You don’t have to enter transactions manually as PayPal fees are recoded as expenses while reconciling the PayPal account.

Connect QuickBooks to Square?

The Square can easily integrate with QuickBooks software. There is a very simple and smart way to fetch transactions from Square to QuickBooks.

1. Easy to import into QuickBooks and no more manual entries

2. It helps you to collect data from multiple locations of your businesses to QuickBooks account

3. Automatically created sales receipts that include sales items and transactions

4. Select the sales details according to you to import the daily summary or individual transactions.

How it works after integrating Square with QuickBooks?

You can easily make the sale using the Square application by connecting it with QuickBooks. Here are the steps to know how it works:

1. Connect Square with QuickBooks

2. Make a sale using Square

3. QuickBooks groups your payments to match them

4. It makes your reconciliation easy

5. Reviews the transactions for accuracy

6. All the sales transactions can be reviewed

You can easily connect both applications Square and PayPal with QuickBooks. The Dancing Numbers help you in importing, exporting, or deleting the transactions related to the software that you integrate with QuickBooks. All the transactions got integrated into your QuickBooks account and Dancing Numbers is providing services for QuickBooks. You can easily import and export transactions to and from QuickBooks in excel format. It saves your time, makes you work easy, provides you automatic processes, and no human errors.

#Square #Paypal #QuickBooks

Here is how you set up 1099s forms in QuickBooks.

Step 1: Prepare the vendor account or edit it in case it is already created.

Step 2: In the menu bar, select the Vendor and then choose vendor Center.

Step 3: Choose the new vendor from the vendor’s list or select the drop-down button near the New Vendor left side of the screen and click it.

Step 4: In the new window for Address Info, add the Vendor’s contact details and name.

Step 5: Select the Tax Settings on the left of the screen and add the vendor’s tax ID number in the Vendor Tax ID.

Step 6: Check-mark the particular box that says vendor eligible for 1099.

Step 7: Select OK.

#1099sform #QuickBooks #Howto #Setup

Get complete information about visit: https://www.dancingnumbers.com/set-up-1099s-form-in-quickbooks/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

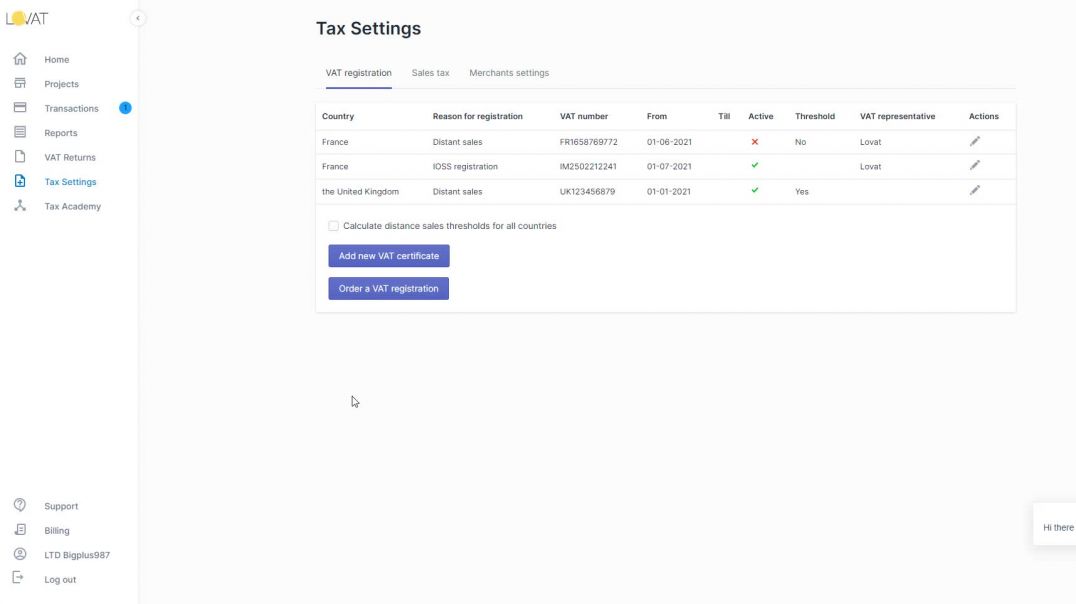

This tutorial will show how you can file your IOSS return. First of all you need to check if you have added your existing IOSS registration number and check if the transactions for the reporting period are already added or they have to be uploaded first. After the information about your IOSS number and transactions is uploaded you can file the return.

Select the country where you are registered for IOSS and the reporting period. The system calculates the IOSS return divided by the countries automatically according to your transactions for all the European countries where you had sales during the needed to be reported period.

If you do not agree with any of the sums written in the IOSS return or if you had sales through another sales channel which you hadn’t added to Lovat platform you can change this information manually by just putting the necessary amount to added or deducted to your revenue. In the last section of your IOSS return preparation you can once again check the information about your revenue divided by European countries where you had sales and the VAT sum calculated according to the VAT rate of this or another country..

You can save this report for your records or submit this IOSS return on your own if you have such possibility. You can submit it immediately by clicking “Submit” or save it as a draft for the later submission. After submission the IOSS return will be submitted to the tax authorities.

When FASB and IASB first announced the lease accounting standards ASC 842 and IFRS 16, respectively, companies scrambled to pull together their lease data and implement procedures and tools to generate the required disclosures.

But as leases changed, many companies struggled to maintain compliance as they didn’t realize the complexity of managing leases, accounting for changes throughout the year, and the implications these requirements would have on cross-functional teams outside accounting.

In this webinar, you will learn:

The common roadblocks to sustainable – and auditable – lease accounting compliance

The ongoing changes companies must account for

The impact of day 2 requirements on cross-functional teams

The critical role of technology in streamlining workflows and maintaining compliance

One company’s journey to sustainable compliance.

Leases are dynamic, evolving documents. Lease changes – and remeasurements – are common, but how to handle them under ASC 842 is not always straightforward. As unexpected circumstances like COVID-19 interrupt business plans, payments or obligations may have changed in unpredictable ways.

Because lease changes are common, FASB devoted much of ASC 842 to lease remeasurements.

In this webinar, you will learn:

Lease remeasurement scenarios, best practices + requirements under ASC 842

How to optimize your processes ensure timely and complete information

Workarounds to get the job done when your processes don't work as should

Government entities and public sector organizations often struggle to comprehend the complex requirements of GASB 87.

Let us break it down for you – and help you be better prepared.

In this webinar, you will learn:

Overview of the adoption considerations for GASB 87

How to perform lessee and lessor accounting calculations

Live preview of GASB 87 lease accounting software solution

Watch Now

On-demand webinar:Planning for lease accounting compliance with GASB 87

Presented by Financial Executives International (FEI) and Visual Lease

Meet the presenters:

Joe Fitzgerald, SVP, Lease Market Strategy, Visual Lease

Andrea Pasquarelli, Manager, Product, Visual Lease

Jason Lucas, Technical Sales Engineer, Visual Lease

Preparing for ASC 842 compliance is incredibly demanding. One of the most difficult parts is knowing what needs to be done – and when.

Don’t fall behind on the important milestones you need to meet this year to comply with the private company deadline.

In this webinar, we will guide you through each step of preparation and share an associated timeline to set up your company for a successful transition.

In this webinar, you will learn:

-The ideal period to begin each phase of lease accounting preparation

-How much time to allocate to each step

-A read-out of lease accounting best practices

Meet the presenters:

Joe Fitzgerald, SVP, Lease Market Strategy, Visual Lease

Alexandra Betesh , VP, Client Services, Visual Lease

Welcome to the Dancing Numbers video which talks about troubleshooting steps when QuickBooks crashes while data export to the Excel. https://www.dancingnumbers.com/quickbooks-crashes-when-exporting-to-excel/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

First you need to ensure the compatibility requirement between QuickBooks and MS Office.

Second, you should update your QuickBooks to the updated version or release to resolve the issue. You can check the updates by going to the product information window after opening the QuickBooks.

Third, you can run the repair tool.

Fourth, you can verify and rebuild data feature in QuickBooks.

If all these don’t resolve the problem, then you can repair MS Office with the help of MS Office.

Another shortcut is an integration of Dancing Number sin QuickBooks. Dancing Numbers is a Sass software that can make your import, export, and delete transactions and reports really effort less.

Thanks for watching this video, please subscribe to us for more on QuickBooks.

Welcome to the Dancing Numbers video which talks about uploading the data from Excel and CSV files to QuickBooks Pro Online.

Before you try and import data, please take a back of your company files.

To start the upload of the data, click on the gear icon.

Click Import Data tab, then select the type of data that you want to import.

Select the file, click open.

Then you will see the data getting imported or uploaded to the QuickBooks pro online.

With the new QuickBooks Pro Advanced version it is possible to simply upload data from Google sheets as well.

Classify the data and then, click Next.

Thanks for watching this video, please subscribe to us for more on QuickBooks. Dancing Numbers helps you convert, import and export QuickBooks Data easily.

Welcome to the Dancing Numbers video which talks about the advanced features of the QuickBooks Online. https://www.dancingnumbers.com/features-in-quickbooks-online-advanced/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

QuickBooks Online advanced features is the latest feather to the QuickBooks Hat of Excellence.

1⃣ Integration of Googlesheets

In this jet age of carry your information everywhere; Googlesheets has helped millions carry their office documents on the go. QuickBooks Online in its latest update has integrated Google sheets as an alternative to the Excel sheets.

2⃣ New Batch Transactions

Batch Transactions now allow you to enter all tier transactions including checks and expenses in batch transactions.

3⃣ Cash Flow

Cash Flow, both in and out of the company, is the cause of major worry for the companies worldwide. In the new QuickBooks Online Advanced version, the users have the option of viewing the cash flow to any client at any given time.

4⃣ WorkFlows

With the new bill reminder, past due reminders, bank deposit reminders, send invoice reminders, customer notification, stamp overdue invoice, and send unsent invoices features, you have a better control on the workflow.

5⃣ Revenue Streams

Along with the cash flows, you have the complete control over the revenue streams now.

Thanks for watching this video, please subscribe to us for more on QuickBooks. Dancing Numbers helps you convert, import and export QuickBooks Data easily.

Welcome to the Dancing Numbers video which talks about how to open different types of QuickBooks File formats without QuickBooks. https://www.dancingnumbers.com/open-quickbooks-file-without-quickbooks/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

QuickBooks is known to save different types of data under different file formats. There are different file formats like .qbw for company file, .qbx as accountants copy and .QBB as back up files.

Open the Company file into your QuickBooks account, Click on File menu option, Select option Open file, Search for the company file having .qbb, .qbx and .qbw extension.

The regular way to open all these files in QuickBooks is demonstrated here.

#HowtoOpenQuickBooksFile

You can open QuickBooks file format without QuickBooks by simply:

☑ Look for the QBX file, then right-click on it.

☑ Select Open with option.

☑ Choose the Excel or Excel Spreadsheet option to open the file.

☑ Click on the option Import from other sources to open the file.

☑ Go to the import page and select the file.

☑ Convert QuickBooks file to excel to continue Check for the file with the QBB Extension.

Welcome to the Dancing Numbers Video which talks about the creating and importing budget in QuickBooks online. https://www.dancingnumbers.com/create-and-import-budgets-into-quickbooks-online/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

To start budgeting, click the gear tool and choose budgeting tab to open the budgeting window.

Now you can select either the import or Add Budget button.

To create a budget, you will have to fill in all the details of the expenses month-wise in a yearly budget format.

Remember that entering all such figures is mandatory to have a current representation of the company financial abilities for expenditure.

Such Budgeting is a often very helpful to keep a tab on the expenditure and earnings to help assess the real impact on finances of a company.

At any given point in time, you can delete any section of the budget if it is not relevant by simply clicking the close button on it.

Once you are done with the filling of all the information, you can click Save or Save and Close.

At the end of filling all relevant information, you might see that there are plenty of rows where there are no figures, you may choose to not show them in the budget.

To Import an already filled Budget from Excel in (.csv) format, you can simply click the Import button, choose the file and click next to import the file.

Hope you learned something new in this video, to learn more subscribe to our channel and website. You can download Dancing Numbers as QuickBooks utility.

Topics Covered here are:

00:00:00 Introduction About Create and Import Budgets in QuickBooks Online

00:00:45 How to Add Budgets in QuickBooks Online

00:00:50 How to Create Budget and Add Details

00:15:17 How to Import Budgets in QuickBooks Online

Welcome to this video about the QuickBooks tutorial, in this tutorial we talk about how to delete the Chart of accounts in QuickBooks Online. https://www.dancingnumbers.com/how-to-delete-chart-of-accounts-in-quickbooks-online/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

Login to your company file.

Click the gear button to search for chart of accounts.

Now, this list of all the chart of accounts, find the one that you want to delete. In QuickBooks Online, it is very convenient to delete a chart of accounts. You can simply inactivate the account that does not serve the purpose.

Now select the account you want to inactivate and select inactive action from the drop down to simply inactivate and delete the chart of accounts.

Thanks for watching this video, for more such process videos and more data conversion tutorials visit our website and subscribe to our YouTube channel.

#Delete #ChartofAccounts #QuickBooksOnline

Welcome to this video about the QuickBooks tutorial, in this tutorial we talk about the how to configure recurring payments in QuickBooks. https://www.dancingnumbers.com..../recurring-ach-payme

It is very important to configure the recurring payments of the customers in QuickBooks Desktop.

To start the process, click on the receive payment button.

Sort out the customer from the drop down.

Select the method of recurrent payment. Enter or edit details for the customer. Most of the amounts will be pre-filled as they are filled on for the customer. You can also enter the other alternate card method details.

You can check for other customers and their details for recurring payments. Check the methods. Once done you can go back to the home screen.

Setting up Recurring ACH Payments in QuickBooks Online

This method shows configuration to accept credit cards, debit cards and ACH bank transfers in QuickBooks Online. The payments generally show up within maximum 5 banking days.

To start the process you will need to log in the QuickBooks Online and click on Settings.

Click the accounts and settings of QuickBooks Online.

Then, click Payments.

Then, click Learn More.

Click start button in the Business section. Select the relevant categories and details. Once done, you click next.

Then, you will need to fill the owner/proprietor details by selecting start. Enter the details and then, click Next.

Repeat the similar process by filling in bank details in the banking category.

Once then, you are all set to go and finish the recurring payment settings.

Thanks for watching this video, for more such process videos and more data conversion tutorials visit our website and subscribe to our Youtube channel.

Topics:

00:10 - Recurring Payment in QuickBooks Desktop

03:30 - Recurring Payment in QuickBooks Online

#QuickBooksRecurringACHPayments #HowtoSetup #Manage #Stop

Mobilesentrix Offers High-quality Precision Earphone Repair Holder Tool for AirPods 1st / 2nd / 3rd Gen (MaAnt P1). High-temperature resistance. 360° rotation. It supports a variety of headphone models. It's made from Durable Materials. A must-have for repair shops.

https://www.mobilesentrix.com/....replacement-parts/ap

Welcome to this video that talks about restoring the deleted transactions that you might have deleted either by mistake or as a bulk delete in QuickBooks. Click HERE for detailed info: https://www.dancingnumbers.com..../restore-deleted-tra

Sometimes you find that you might have deleted some vital transactions and then, you want to regain the same. What is the way out? Well, there are two methods in which you can regain all the information lost.

Method 1: Restore Deleted Transactions Using Backup Files

This is the best way to restore transactions, however, it is effective if and only if there was no more transactions after you deleted the transactions.

Step 1

Restore the latest backup file. If the deleted transaction is one of a few transactions you can restore the most recent backup file. To do this, click on the QuickBooks "File" menu on and scroll down to the "Open Or Restore Company" button.

Step 2

Click on the "Restore A Backup Copy" button and click "Next." The software prompts you to answer the question, "Is the Backup Copy Stored Locally or Online?" If you stored the backup to an external drive or flash drive, choose the "Local Backup" button and click next.

Step 3

Find the most recent backup copy stored on your computer. The software prompts you to choose the location in which it should search for the backup file. Select this location and click "OK". When you see the most recent backup, double click on it and then click "OK".

Step 4

Choose a location to save this backup copy. After you locate the backup file, the software asks you to specify where you want to save the new company file. Choose the default location of the external drive or flash drive you currently use and click "OK".

Step 5

Open the file and check for the presence of the deleted transactions. Re-enter the transactions that were entered between the time that transactions were deleted and the time that you restored them. Re-enter all data that was entered following the deleted transaction as needed.

Method 2

This is a time taking method, in case if you have deleted many transactions, however, there is no harm to data that you have recently entered.

Click on the "Reports" button on the top menu bar. Scroll down and click the "Accountants & Taxes" button, then click on the "Audit Trail" tab. It's the Audit Trail that captures each transaction that is entered, altered, or deleted.

Select the date type and then, manually enter the date range. Click on the "Refresh" button and the Audit Trail will display all transactions within the date range you specify.

Scroll through the list of transactions and double-click the one that was deleted. Make a note of each item in the transaction. The audit trail is organized by the user who created or last altered the transaction, then by transaction type, then by the date it was created and then by the date it was changed.

In case of a deleted invoice, create a new invoice with the details from the deleted transaction. If it is a bill or a bill payment, create a new bill or bill payment with the deleted details.

Welcome to this new video which talks about how to Edit and Delete memorized transactions from QuickBooks company file. https://www.dancingnumbers.com..../create-edit-or-dele

You can always contact us at Dancing Numbers to help you with all QuickBooks desktop issues. Dancing Numbers is SaaS-based software that can easily be integrated with your QuickBooks account. Using Dancing Numbers you can simplify and automate the process, saving time and increasing productivity.

Coming back to our task of the day, you can easily edit and delete the memorized transactions from Quickbooks by following some specific steps.

At first, go to the list on the top menu and click on ‘Memorized transaction list’.

In this step, click to highlight the transaction from the “memorized transaction list’ window.

Now click on the drop-down menu and choose ‘Edit Memorized transaction’. Edit the details and click OK in the confirmation window.

To delete the memorized transaction, you can click on the drop-down menu and choose ‘Delete Memorized transaction’.

And at last, click on OK when you get the confirmation window.

Suggested Videos for Learning QB Online:

QuickBooks Desktop Tutorial: Download, Setup, Chart of Accounts, and Banking - Part 1: https://www.youtube.com/watch?v=dg2enrtZeTQ

QuickBooks Desktop Tutorial: Invoices, Receipts and Credits - Part 2: https://www.youtube.com/watch?v=nbBQfYCcduY

Welcome to this video which talks about void checks and how to delete such checks from the system. Visit For More: https://www.dancingnumbers.com/delete-or-void-employee-paychecks-in-quickbooks-payroll/?utm_source=youtube&utm_medium=video&utm_campaign=yogesh

The process to void the checks is carried out for the people who have either left the company or have opted for a different payment plan other than the existing one.

For this, you will visit the employees center in the QuickBooks desktop to view the payroll cycle and the pending or new checks.

Click on the payroll checks, then, view the details.

Now, select the employee check you want to void and just click the void button to make it.

To delete the checks that you want to delete from the list, simply select the check and click Edit. Now you can see the Delete button on the top bar. You have to click that Delete button to delete the check.

Hope you learned something new, for more such informative videos and information subscribe to our channel and talk to our experts at Dancing Numbers.

Suggested Videos for Learning QB Desktop:

QuickBooks Desktop Tutorial: Download, Setup, Chart of Accounts, and Banking - Part 1: https://www.youtube.com/watch?v=dg2enrtZeTQ

QuickBooks Desktop Tutorial: Invoices, Receipts and Credits - Part 2: https://www.youtube.com/watch?v=nbBQfYCcduY

We want to make sure this time around, we position our AQ line correctly. While AQ7 is not our premium line, it is by far better than the competition’s best grade. Moreover, the AQ7 line uses the best sourceable materials in China without trying to cut corners. That way, you and your customers have the best displays available.

The reason we can make AQ7 very price competitive is because we focus on volume. In addition, we use the best materials probably and keep real-time margins, so savings are always on the clients’ side. While other suppliers might try to compare their screens to our XO Technology, they can never compete. Instead, they would be trying to compete with our AQ7 line, and even then, we are confident they can’t beat that quality!

It has Thinner IC is something the industry has been waiting for a long time, and you will be able to have this technology in AQ7 Technology. Premium Oleophobic Coating on AQ7 Screen for Smooth screen operations. It comes with Vibrant Colors and it has True Tone Functionality and Faster Refresh Rate. AQ7 has Force Touch Panels installed. We ensured that every LCD comes with the authentic 3M ESR film. We have taken the structural core panels, the software, the LCM panel, the flex cable, new LED lights are being implemented in AQ7.

CASPER Silicone is the next-gen of tempered glass. It

extends out to the edges adding a nice silicone protection layer around the

device. This silicone extends beyond the curvature of the glass to protect

against impact. CASPER Silicone is ready to help against any impact.

https://www.mobilesentrix.com/....brands/casper-temper

• CASPER UV tempered glass comes as a solution to the

industry after carefully reviewing the current products in the market. It

revolutionizes the main three issues with the existing products.

1. STRENGTH and

CURVATURE - No existing tempered glass is as strong, flexible, and it can

adhere to a curved screen as Casper UV.

2. A premium UV

adhesive and well-thought dispenser. - Forget the old-time dispenser; we have improved

to have a well-sealed lid for an easy to dispense experience. Oh, and did we

mention the premium glue inside the magic new bottle? You will absolutely love

it!

• CASPER UV tempered glass and Casper UV Box is the new and

improved technology in the screen protection industry. It achieves total

adhesion and prolonged strength.

https://www.mobilesentrix.com/....brands/casper-temper

Casper UV Box - We have created a UV box exclusively

designed to install UV tempered glass perfectly. Casper UV box is the perfect

size for most phones, with UV LEDs aligned to reach the device surface

perfectly with a calculated timer for best results.