Lovat Compliance LTD

|Subscribers

Latest videos

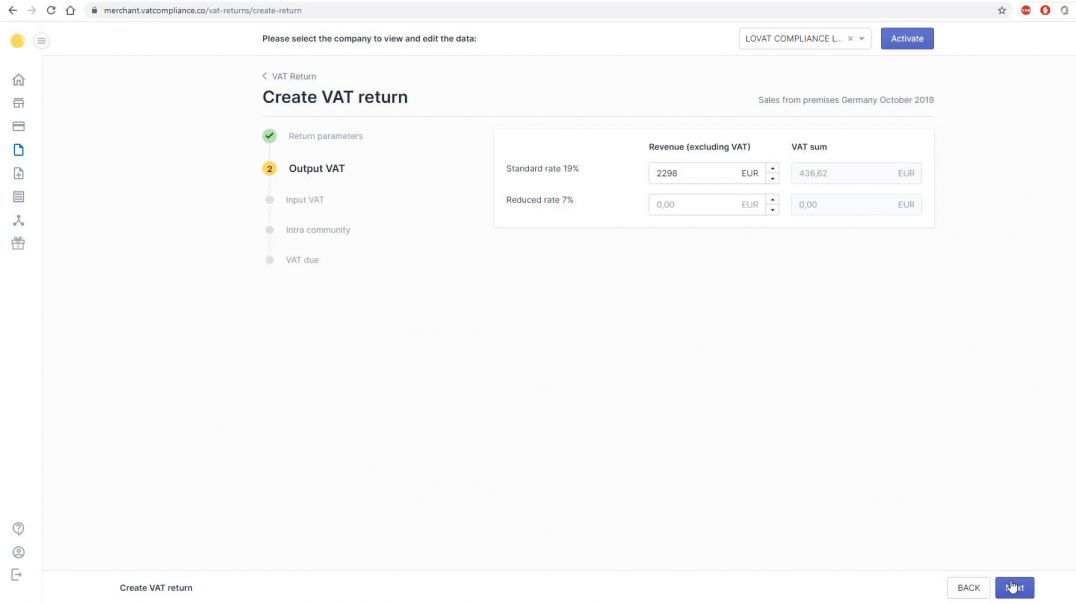

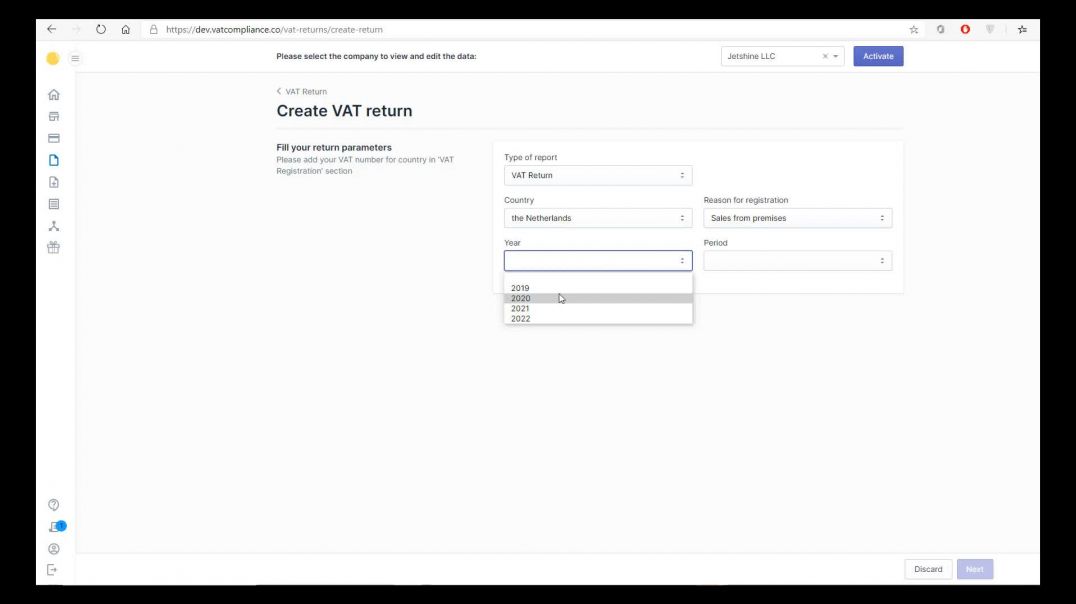

This tutorial will show how you can file your IOSS return. First of all you need to check if you have added your existing IOSS registration number and check if the transactions for the reporting period are already added or they have to be uploaded first. After the information about your IOSS number and transactions is uploaded you can file the return.

Select the country where you are registered for IOSS and the reporting period. The system calculates the IOSS return divided by the countries automatically according to your transactions for all the European countries where you had sales during the needed to be reported period.

If you do not agree with any of the sums written in the IOSS return or if you had sales through another sales channel which you hadn’t added to Lovat platform you can change this information manually by just putting the necessary amount to added or deducted to your revenue. In the last section of your IOSS return preparation you can once again check the information about your revenue divided by European countries where you had sales and the VAT sum calculated according to the VAT rate of this or another country..

You can save this report for your records or submit this IOSS return on your own if you have such possibility. You can submit it immediately by clicking “Submit” or save it as a draft for the later submission. After submission the IOSS return will be submitted to the tax authorities.

In this video

we concentrate on and give additional information about such section as

“Intra-Community Acquisitions and Supplies”. This is the 4-th section when

you’re filling your VAT return on LOVAT platform. There are 2 steps with 2

types possible for each step here.

Let’s start

with “Intra-Community Acquisition”

The first type here is purchase of goods from Supplier of other EU country. For

example, you’re submitting your German VAT return but bought goods from Belgium

supplier at the same time and paid him 1000 EUR for the supply of these goods.

From his side he will invoice you with so-called “reverse charge invoice”. It

means that VAT should paid by us in the destination country – Germany in our

case.

All such

reverse charge invoices containing your German VAT number should be filled on

this step. The second type for this step is when you’re moving your own goods

from one country to another. For example we send our goods from our Polish

warehouse to our German warehouse during this month. In this case we should

invoice ourselves to our German VAT number from our Polish VAT number. Let’s

fill it – we’ve invoiced ourselves for 2000 EUR with standard rate. The VAT sum

is 380 EUR. We fill our Polish VAT number here and add this record as well.

Now we’re

moving to another part of this section – Intra-community supplies. Here can be

two types of operations as well.

The first

one is sales to customer with VAT number in another country.

The second

type of operations here is regarding the movement of goods.

After we

filled this step – below you can see an opportunity to order a Sales List

report. This is a special report for these kind of sales or movement of goods

operating with another VAT number. It is a mandatory report if you had any and

you can check if it is already available in your subscription or order it.

Sales List report will be automatically formed along with your VAT return.

Hello, in this video we'll show how to fill such sections as

"Stores" and "Tax Settings"

1) First of all, make sure that you have filled your company profile.

2) Afterwards, you need to complete integrations with your stores in the

"Stores" section.

If your store is managed by an Amazon fulfillment center or managed by a

merchant actual address will be uploaded automatically by default settings of

the platform.

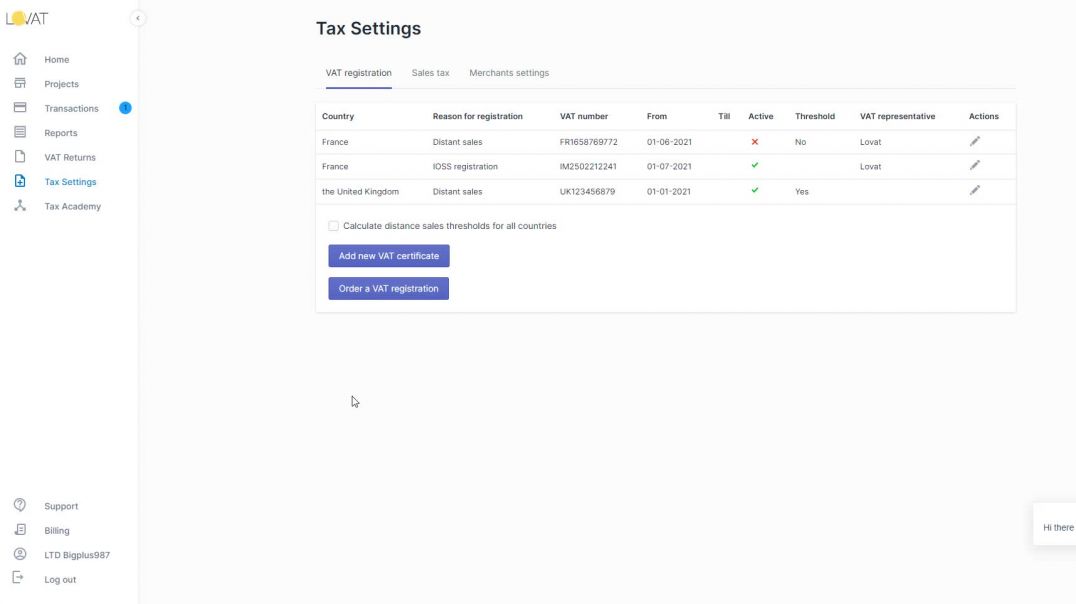

3) The next step is section "Tax Settings" where you need to

fill in information about your company in regards to VAT and Sales Tax.

Please note that you must add a VAT number by the VIES standard.

4) It's important to consider the reason for registration.

The next step is to add your actual date of registration.

Section "Valid till" will be applied only in case that you

need to deregister your VAT certificate.

Now, let's go to the Sales Tax section.

This section is intended only for the American market. If you have sales in the American market, then you need to add all sales tax permits.

Only after you add at least one sales tax permit you will see the sales tax return section.

For states where you have already added sales tax permits, you will have an understanding of the nexus.

If you want the Lovat platform to calculate the economic nexus for other states - please click "Calculate threshold for economic nexus for all

states" - and then you will see on the dashboard in which states you are approaching the nexus.

The next setting here is the section "Еxemptions"

This setting is very important if you are using the API provided by Lovat.

A guide on how you should fill in the information about your incoming invoices in the VAT return (Step 3).

Such information filled allows you to claim back (deduct) your already paid VAT from your VAT return.

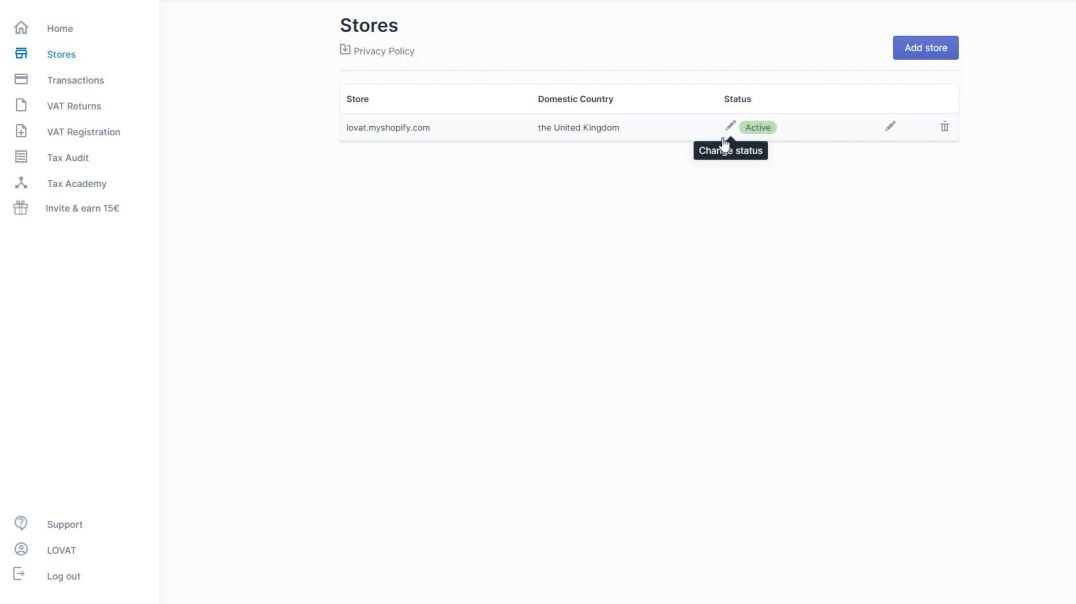

In this video we will show you how to upload your shopify transactions.

After we have completed the integration of your Shopify store and download

platform and its status being “active”, you can upload your transactions from

Shopify directly to the platform. In order to do so go to transactions section.

Here your transactions will be stored after you upload them. To do so

choose “add transactions”, select your store, and the necessary period for

which you want to upload your transactions. Click “Next” and after some time

depending on the amount of your transactions you will see them uploaded to the

platform. Showing such information like date and time, the country of the

transactions, its sum and the VAT amount.

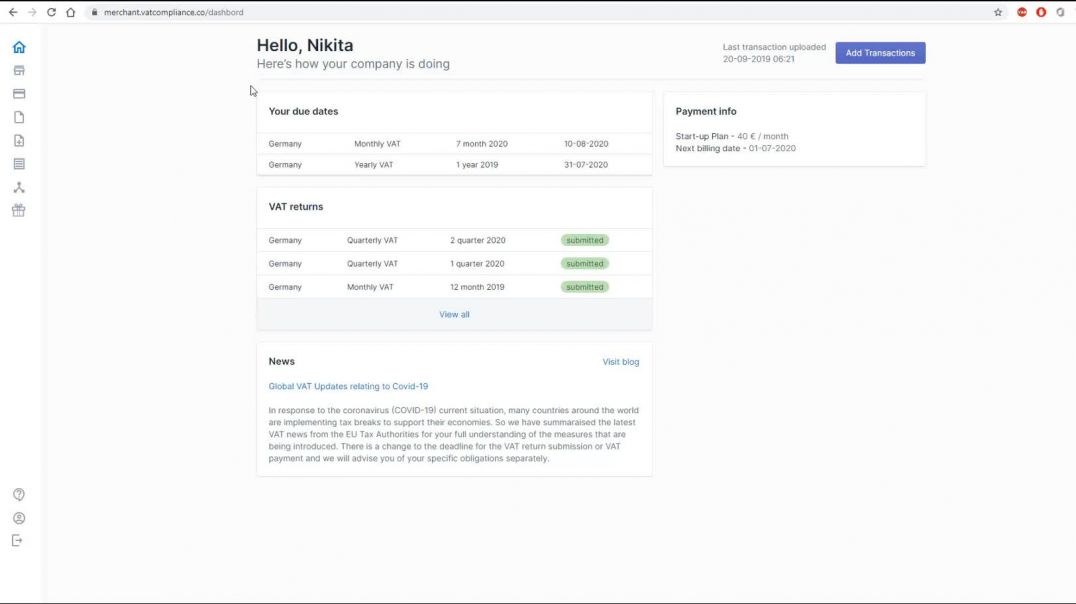

From this moment, if you have an active subscription you can file your

VAT return. It will be prepared by the platform according to your transactions,

the country where you need to report and the necessary period.

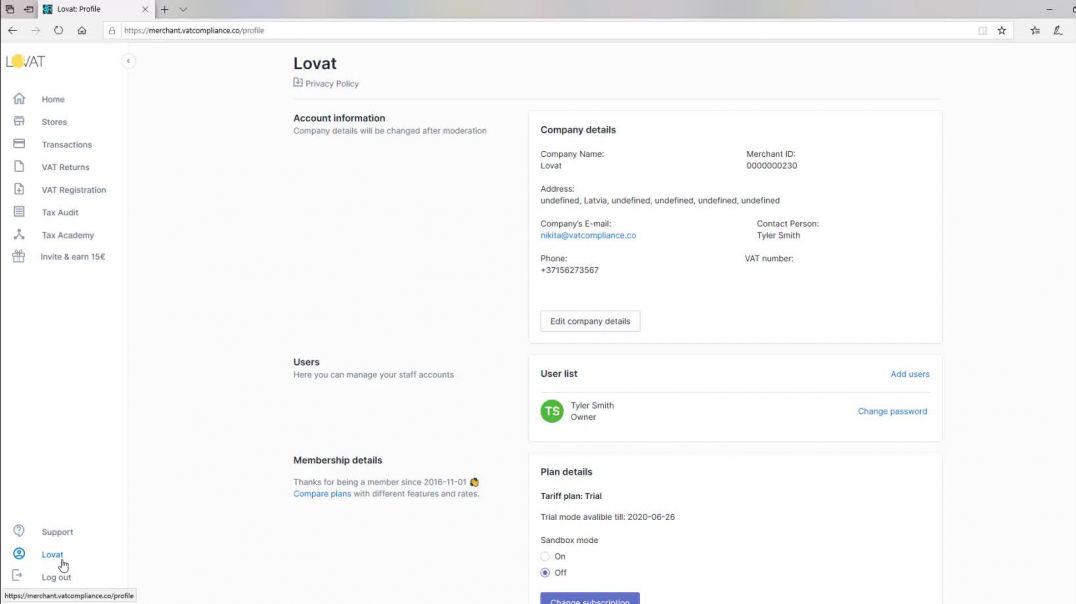

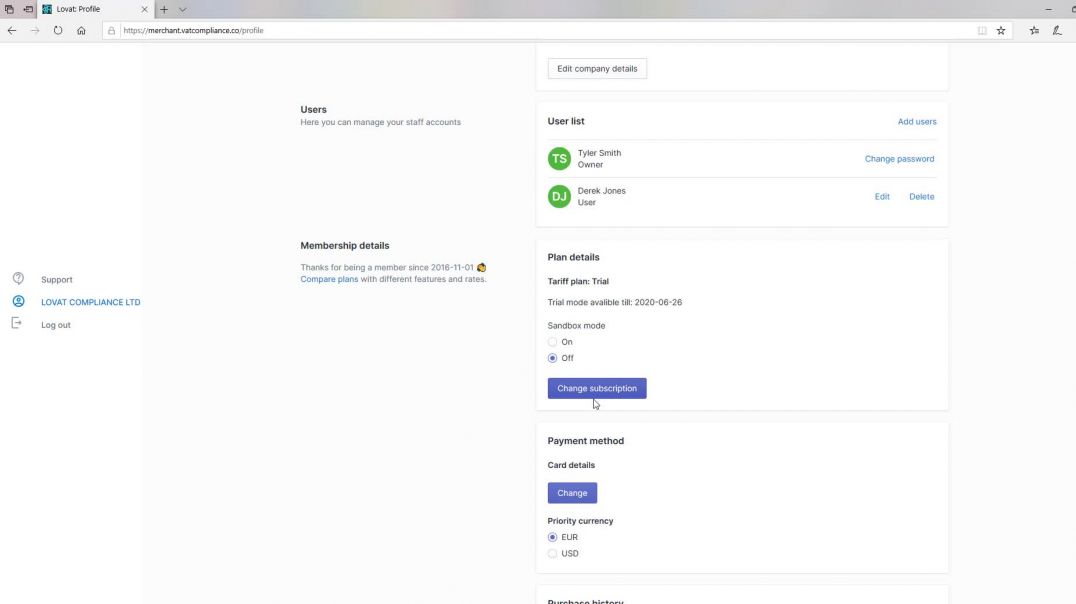

How to fill in sections Store and Tax settings. In this video we will show how to fill in such sections as store and tax setting. First of all, make sure that you have filled in your company profile. Please, check if you set the correct country in the section "domestic country". That means the country where your company is established. As the transactions will be VAT counted according to your domestic country. For example, in the USA you have to choose also the state, zip code and address. For the UK you have to choose the state also ( England or Nothern Ireland). The next section is "Tax settings" where you have to fill in the information about your company and VAT tax. You need to add all your current VAT numbers. It takes some time for activation of your digital VAT numbers. Please, make sure that you have updated all your required VAT numbers because missing information may cause mistakes in VAT counting and VAT reporting. Also we have thre more reasons for registartion in the section ''Tax settings". The first one - is the Online Market place, the second- is the OneStopShop starting from the first of July 2021, the third- is the Import scheme for import registration. Note that for some countries you will need VAT represenative. Chooseing LOVAT as VAT representative the price will b added to your standard price. Also you can calculate how close you are to the thresold of all the countries you sale to. You can order VAT registration. The section "Tax settins" is intended for american market only.

A guide of how to fill in a profile

A guide on how to choose a subscription plan for account

Tutorial about filing your yearly VAT return with LOVAT platform